Confluent (CFLT) Analysis

An exciting tech company with a large market opportunity

Confluent (CFLT) is another recent IPO that I have been watching closely. This company is interesting because their platform enables real-time data streaming, a fast growing market opportunity that will become a necessity for the modern enterprise - more on that later. The stock itself has had a rough time lately and it still trades at a pretty steep forward multiple (~19), so more downside could certainly be ahead. I do own a very small position at this time (less than 1% of my overall portfolio), but I will be interested in adding more (possibly a lot more) after the company reports earnings in May.

What do they do?

Confluent’s mission statement says it all: they put data in motion. As a company’s operations become more and more reliant on numerous software applications, it will be vital to break down data silos and utilize data more efficiently. Confluent offers a platform that acts as the “central nervous system”, connecting applications, systems and data in real time. Rather than sitting in a static database waiting to be used, Confluent mobilizes data in real time to power applications. This graphic from a recent earnings presentation illustrates how data is consumed on the Confluent platform.

The Confluent platform is basically a commercialized distribution of Apache Kafka, which is an open source data streaming platform. Anyone can roll out Kafka, but Confluent has created the best and most complete distribution of Kafka on the market. They’re able to do this because the company is run (and was founded by) the original developers of Apache Kafka. 70% of the Fortunate 500 companies already use Apache Kafka, so there is a massive demand for a cloud-native enterprise-grade Kafka platform.

Messy, disconnected ecosystem:

Confluent:

Business Model

Confluent offers a single product with multiple deployment patterns: fully managed and self-managed. The self-managed platform is a subscription-based product deployable in the customer’s environment. The fully managed cloud platform is hosted (Azure, AWS, GCP, etc.) and is offered as a subscription or pay-as-you-go service. Confluent can land clients on a pay-as-you-go basis hoping they adopt new use cases and become subscription customers.

Financials

This company is in hyper-growth mode, growing revenue 58% and 64% YoY in 2020 and 2021, with 41% and 35% growth expected in 2022 and 2023. Gross margins are good (65%), the company has a large cash reserve ($1.3 Billion) and dollar-based net retention rate has grown from 125% to 130%, both impressive numbers. However, as to be expected with a company burning cash to obtain customers, Confluent is not close to being profitable. Free cash flow is negative and there is over $1 Billion in debt on the balance sheet - this is convertible so it could result in share dilution.

Management & Culture

Confluent is run by its founders, has a well-respected CEO in Jay Kreps and strong ratings on Glassdoor.com (99% CEO approval and 4.4 stars overall). Management also owns a modest percentage of the company, with the CEO owning over 10% of all shares outstanding. As far as skin in the game goes, this management team is the gold standard for everything I want to see in a potential investment. Decent inside ownership and Glassdoor ratings aside, I love that these guys have been working with Kafka since the day it was created. It gives me a great sense of conviction going forward.

Risks

One of the reasons I don’t own a larger stake in this company is the optionality component. I like companies that have demonstrated the ability to add and grow new products consistently. Confluent has a lot of use cases that center around the use of their single platform, but they don’t offer multiple different products. I would like to see how they expand the platform as the company grows.

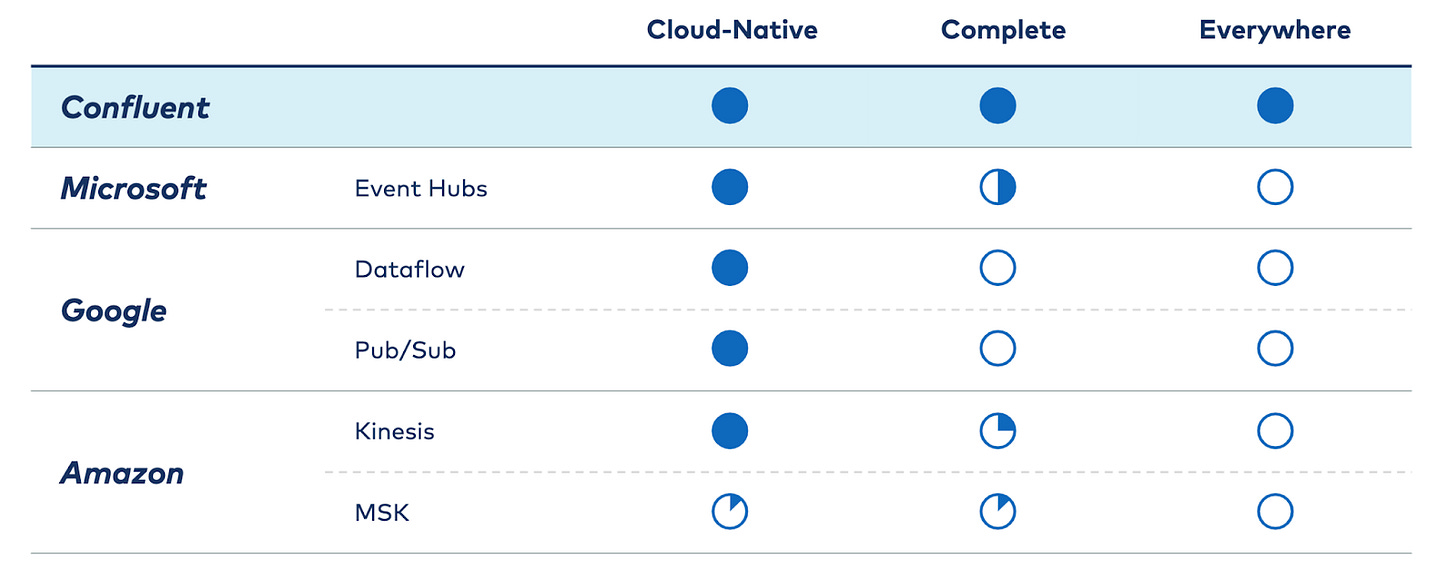

There are a few other risks I see: negative free cash flow and they aren’t close to being profitable. It’s normal for hyper-growth stocks to burn cash, but it’s still something to watch out for going forward - especially since they aren’t generating mountains of cash like some of their tech sector peers. The biggest risk, however, is competition. They offer a single product that Amazon, Google and Microsoft all offer as well. Fortunately, Confluent is the best Kafka offering on the market, so they do have a product advantage. This chart from the most recent earnings presentation demonstrates how Confluent compares with Microsoft, Google and Amazon. Despite having an advantageous market position, these three companies have massive cash reserves and the ability to invest in developing better Kafka solutions, so this will always be a risk.

Why Invest?

Despite the risks, the founders and top executives are the original developers of Apache Kafka, which is an enormous competitive advantage. Revenue is growing extremely quickly, a sizable cash pool is there, and the company is not strapped with a ton of debt. Most importantly, this is a product that could become a necessity for the modern technology stack as companies become increasingly reliant on many otherwise disconnected software applications. The growth runway is massive and if the company continues to perform at this level, I will certainly be increasing my exposure.