Disclaimer: the content within should not be misconstrued as financial advice. Please do your own due diligence before purchasing any equities discussed in this article.

In my screening process, I find it easy to skim past most hardware technology companies. Rarely can these companies effectively incorporate recurring revenue into their business models and establishing a moat typically requires garnering extremely strong brand loyalty. This is one of the reasons I gravitate toward innovative software companies. Most companies I invest in are secular compounders providing mission critical services to enterprise organizations - cybersecurity, observability, monitoring, cloud computing, database-as-a-service, and so on. The businesses themselves are nearly recession-proof, which is what makes them attractive investing opportunities.

So looking at Intuitive Surgical ISRG 0.00%↑ -- does a company that sells extremely expensive surgical robots fit this mold? Well, sort of.

In this deep-dive, I’ll detail the business model, discuss the forces driving the robotic-assisted surgery market, then present the compelling bull and bear cases. This is an unbiased discussion about a company that I find to be fascinating, but do not currently own. I will also note that I am not an expert in any type of medical field -- opinions are based exclusively on facts derived from my research process. With all of that out of the way, let’s talk about Intuitive Surgical.

1 -Intuitive Surgical -- Becoming an Industry Giant

As I mentioned, Intuitive Surgical is a highly specialized hardware company. Having operated since 1995, they are one of the original developers of robotic surgical systems. Their machines allows surgeons to perform a number of procedures with the assistance of highly advanced robotic arms. Intuitive systems specialize in minimally invasive, soft tissue procedures.

Minimally Invasive Surgery (MIS) - a type of surgery performed with small incisions, generally guided by a small lens inserted into one of the openings. A procedure type known to cause less pain and scarring.

Intuitive’s surgical devices allow surgeons to operate on a patient from a freestanding console, which communicates with robotic arms that mirror the surgeon’s precise movements. They also sell a lung biopsy machine, as well as instruments and accessories for the various surgical systems (much more on this later). For now’ we’re going to focus on the Da Vinci.

Da Vinci

The Da Vinci is Intuitive’s flagship product, the device that gave rise to Intuitive Surgical in 1995. Well, technically the Da Vinci was commercially launched in 2000, but its predecessors (aptly named Leonardo and Mona) were in development by Frederic Moll and his team in the mid 90s. When the first generation Da Vinci Standard finally hit the markets in 2000, it was the first of its kind.

Since this polaroid was snapped, Intuitive has rolled out four generations of Da Vinci systems, with the modern 4th generation system consisting of the Xi, X and SP models. These devices are all branded as Da Vinci systems, but each specialize in different types of procedures.

The Da Vinci Xi and Da Vinci X models are similar in terms of functionality, but the X is marketed as more of a budget-friendly device. Both systems utilize the same instruments, but the Xi has broader capabilities and is designed for multi-quadrant surgeries.

Multi-Quadrant - procedures where the instruments must be able to reach all the way across the abdomen and chest

The Xi can be used for all types of procedures (complex and benign), while the X does not support functional requirements for more advanced operations.

The third Da Vinci system is the SP, which has a slightly different design. Rather than multiple arms with single instruments, the SP contains a single arm with multiple instruments. The SP is designed to reach more narrow spaces, providing opportunity for new procedures that the Xi and X models are unable to effectively perform. In many cases, hospitals purchases multiple different systems to adequately provide coverage for the various procedures these machines are capable of performing.

Ion

Intuitive’s latest system to receive FDA approval is called the Ion. Where the Da Vinci specializes in soft tissue procedures, Ion is designed to perform minimally invasive lung biopsies. Armed with a thin and maneuverable catheter for collecting samples, the Ion allows surgeons to operate with improved stability. The thin catheter also enables surgeons to access lesions deep in the lung that would otherwise be inaccessible. For anyone interested in reading more about how this works, Intuitive’s website has some fascinating documentation on their website here.

Ion represents an expansion into diagnostics from what was traditionally a company specializing in soft tissue surgical systems. Several competitors are venturing into diagnostics, so it’s a logical path for Intuitive to pursue. Ion has not yet been approval for international sales, so sales of this system could increase rapidly once these regulatory obstacles have been removed.

Instruments and Accessories

One of the most important pieces of the company’s business model comes in the form of the instruments that attach to the robotic arms. The company offers a wide variety of tools that are interchangeable depending on the procedure. Examples including forceps, stapling, scissors, and many others viewable in their catalog, found here.

Accessories are another important offering -- things like cameras, sterilization trays and endoscopes, among others. These are generally items designed specifically to be used with Da Vinci systems. We’ll discuss the significant impact instruments have on the company’s business in the next section.

2-Business Model

Intuitive Surgical’s business model isn't terribly complicated, as they really only have a handful of different revenue streams. Da Vinci and Ion systems, as well as surgical instruments and accessories are sold to hospitals and outpatient surgery centers. This is Product Revenue, and it is the company’s core business. Intuitive also provides services to existing customers through maintenance contracts - recorded as Service Revenue. I’ll spend a fair bit of time on Product Revenue as it has a much more significant impact on the company’s business.

Product Revenue

Product revenue is categorized as either Systems Revenue or Instruments and Accessories Revenue. When Intuitive sells any kind of hardware, it is recorded on the product revenue line. Historically, product sales have represented around 84% of the company’s total annual revenue. Within Product Revenue, roughly 65% is comprised of instruments and accessories sales, while the other 35% is the result of systems sales.

Systems Revenue: Intuitive generates revenue from the sale of its surgical systems - the Da Vinci systems and the recently introduced Ion system. Each device fetches between $500,000 and $2.5 million, depending on the model. This is the company’s growth driver -- services, instrument and accessory sales are all directly tied to the number of surgical systems the company installs. The reason being that instruments are reusable a set number of times and must be restocked. Thus, more installs leads to more procedures which leads to more instrument sales.

Most of Intuitive’s customers buy the machines outright, but some opt to enter into either an operating lease agreement, or a usage-based contract where they pay for each procedure performed. In both cases, customers do not actually own the machines, but they have the option to purchase the equipment outright through a buyout clause. Lease and usage-based revenue is billed as Systems Revenue, but it also falls under the Recurring Revenue umbrella. We’ll further digest that in a minute.

Instruments and Accessories Revenue: When an operation is performed, Da Vinci systems employ various basic surgical instruments (scalpels, scissors, forceps) and other advanced instruments (staplers and vessel sealers). These instruments have limited uses - they must be replaced after a certain number of procedures. And the best part? Customers must purchase these tools from Intuitive, as they are not universal.

Historically, surgeons could use a tool up to 10 times before switching it out. Due to varying usage limits, Intuitive earns between $600 - $3500 per procedure performed. These numbers have since changed as the company introduced an extended use program in 2020, wherein newly manufactured instruments could be used 12-18 times, extending the shelf life of the tools. This is great for customers, but it does decrease revenue per procedure - Intuitive estimates customers will experience savings rates between 9-15% as they have also lowered the price for some instruments used in lower acuity procedures. However, adoption of advanced instruments has progressed quickly and has served to help offset any revenue loss from the introduction of the extended use program. The graphic here demonstrates the rapid of adoption of these advanced instruments:

Back to the question posed early on, how does this company fit into my mold of subscription-based software companies? The truth is, there are a lot of similarities. When a healthcare facility purchases a surgical system, they pay up-front for the product and Intuitive installs the machines (like software implementation). Once onboarded, Intuitive customers sign a services contract for technology support, servicing and consulting (software maintenance). Finally, as surgeons perform procedures, the tools wear down and hospitals need to restock (usage-based plans). In short, Intuitive lures customers in with the surgical systems and extracts consistent, reliable revenue through the recurring sale of instruments. This is a hardware company with 75% of its revenue categorized as recurring in nature. It’s a wonderful business model.

In a lot of ways, Intuitive systems are stickier than most software solutions. The training involved to learn these machines is rigorous, and switching to a new system is both expensive and difficult, as surgeons would need to learn a brand new device. It would take a significant catalyst for a hospital to decide to switch providers. This is one of the reasons the company has been so successful for such a long time.

Service Revenue

When a customer purchases a Da Vinci or Ion system, they also enter into a service contract. Within the terms of this contract, Intuitive installs the system, provides around the clock support, as well as repair and maintenance services. They also provide consulting, operating room consulting, and hospital analytics services. Customers either sign service agreements or time and materials contracts. The service contracts are typically valued at $80,000 - $190,000, and time and materials revenue may vary.

There really isn’t a whole lot to break down here, but it is worth noting that service revenue falls under the realm of recurring revenue, which I will cover next.

Recurring Revenue

I teased this earlier, but the true beauty of Intuitive’s business model is that much of the company’s revenue is recurring in nature. Many of the SaaS companies I invest in monetize users through a subscription model, but Intuitive’s model is a bit different. Much of their recurring revenue (~72%) is generated from the sales of instruments and accessories. Another 20% comes from services and the remaining 8% is realized from financing agreements for Da Vinci and Ion systems (leases and usage-based arrangements). Unlike software subscriptions, instrument sales are dependent on usage volume (procedures), making the recurring revenue portion more volatile. To sum up the reasons for this volatility:

Instrument and accessory sales are directly tied to procedure count. As more procedures are performed, hospitals need to restock more often.

Usage-based leasing model revenue is also reliant upon procedure count for the same reason as instrument and accessory sales.

Operating lease revenue can vary as the total number of customers under lease agreements may grow more quickly over any given study period.

Time and material service contracts may produce vastly different revenue numbers depending on required services in any given quarter / year.

In general, recurring revenue as a percentage of total revenue is trending upward. In recent years it has taken a larger share of total revenue as the Da Vinci install base has expanded and procedure counts have grown. From the table above, note the jump in recurring revenue as a percentage of total revenue in 2020. With only 936 systems installed in 2020 (down 16% from 2019), instrument and accessories sales helped to insulate the company from a potentially disastrous fiscal year. This perfectly encapsulates the importance of their recurring revenue model.

Resilience in the Face of Powerful Outside Forces

As you can tell from these charts, 2020 was a difficult year for Intuitive. The outbreak and subsequent spread of Covid-19 proved to be a powerful headwind as elective surgeries were postponed or deferred and procedure growth stalled. While 2020 was a challenging year for growth, Intuitive’s strategic business model shielded the company from further losses. Total revenue only dropped by 2.6%, including a 3.2% decrease in Product Revenue. The major loss came from Systems Revenue, which fell 12.6% year-over-year as a result of far fewer systems placed (936 vs 1119 in 2019).

The point of this is that even in the face of global pandemic and a year where the company installed 16% fewer systems, revenue only fell 2.6% and instruments and accessories revenue actually grew from 2019 ($2.4 to $2.46 billion). As a result, recurring revenue grew as well, from $3.2 to $3.4 billion. As 73% of the company’s annual revenue (on average) is recurring in nature, the top line is less sensitive to fluctuations in systems sold. This demonstrates just how strong this business model is and how much protection recurring revenues provides from such powerful outside forces.

As a final comment on the business model, management notes that they generate non-material revenue from digital and learning solutions. The revenue breakdown isn’t discussed and it was hard to dig up any useful information on how they monetize customers through these digital solutions. It seems that the My Intuitive app, Intuitive Hub, hosted & managed services and 3D modeling services are mostly complementary offerings that empower customers to improve their operations. I go into much more detail on this later, but I feel that this could be a strong revenue-generating opportunity.

3-Opportunities in the Robotic-Assisted Surgery Market

There are two key factors that will be vital to the robotic surgical market’s growth projections. The first is the general adoption of robotic assisted surgeries. Not only does Intuitive have to sell their system to potential customers, but they often need to convince customers that robotic surgery is better than conventional minimally invasive surgery.

The second key factor at play is the expansion of clinical applications. Intuitive has been a market leader for a long time, but continued dominance will be dependent on creating new use cases within their existing specialities as well as venturing into new practices.

Adoption of Robotic-Assisted Surgery

As an industry disruptor, one of the most signficant hurdles for Intuitive is the industry-wide adoption of robotic surgery. Only around 2% of global surgeries are performed with robotic-assisted systems. I’ll expand on this statement by clarifying that the 98% of global procedures that are performed without robotic assistance do not represent Intuitive’s market opportunity. It’s just not realistic because many surgeries do not really benefit from robotic systems.

To obtain a more reasonable estimation of Intuitive’s current addressable market, we need to look specifically at the types of procedures that Intuitive systems can perform. On average, 44.5 million soft tissue operations are performed in the U.S alone each year. Intuitive estimates that their total addressable market is around 20 million annual procedures. As of 2021, Intuitive held about an 80% market share of the robotic-assisted surgery market. To put that in perspective, in 2021 that 80% figure only represented 1.6 million procedures.

These numbers provide a degree of optimism for the future, but I’ll reiterate that the industry as a whole must further adopt robotic surgery if Intuitive is to continue growing. Remember, Intuitive’s growth is driven first by system placements. Recurring revenue is largely dependent upon the number of procedures performed, but the install base drives the company’s growth. If robotic-assisted surgery does not gain popularity, growth will eventually stall.

The good news is that robotic-assisted surgery is becoming more commonplace. Estimates suggest a 17.6% CAGR through 2028 for the robotic-assisted surgery market, which equates to a $22.3B market. While the market is growing organically, Intuitive (and their competitors) have the opportunity to further expand that market by developing new systems and instruments for new types of surgeries. The graphic below highlights the consistent growth of the robotics market and breaks it down by procedure type.

Heavy marketing by doctors and healthcare facilities has created this interesting dynamic where public perception of RAS has become overwhelmingly positive, leading to patients specifically seeking out facilities offering robotic surgery. The public largely believes RAS is significantly better than conventional minimally invasive surgery despite evidence suggesting that its really just somewhat better. Proponents of RAS within healthcare circles have planted this seed within the public that has spread and proven to be a powerful driver for the growth of the surgical robotics industry as many patients opt for robotic surgery because they believe this advanced technology must be better, rather than considering any pros and cons.

Despite optimism for secular growth in the RAS market, there are some significant obstacles that could contribute to a slowdown. Much of this will be detailed in the bear case section, but it does help to understand the dynamics driving the market so I’m going to hit some of the high points.

One of these obstacles is the high barrier to entry - $500k is a hefty capital investment for many hospitals for just a single system ($1-$2.5M for the more advanced machines). With a recession on the horizon (or maybe we’re in one right now -- this is a debate I will not partake in), hospital budget cuts and decreased consumer spending could result in fewer robotic surgical system purchases and potentially fewer procedures. Certainly a near-term headwind for individual providers like Intuitive, it could morph into a more prolonged trend if hospital spending stalls.

There are also those who believe robotic-assisted surgery does not really improve results over conventional minimally-invasive surgery. Nobody doubts the advantages of robotic-assisted surgery over open surgery, but whether or not these systems are truly worth the money is hotly contested. We’ll hit both sides of this argument, but for now just keep in mind that this debate is happening in the medical community.

Clinical Applications

Along with industry-wide adoption of robotic-assisted surgery, it will be important to create opportunities for new procedures. Today, Da Vinci systems have 70 use cases across general surgery, urology, gynecology, cardiology and head and neck procedures. The addition of Ion to the Intuitive family of surgical tools also creates opportunity in the realm of bronchoscopy procedures.

In addition, several competitors have developed systems able to perform orthopedic procedures and spinal surgeries. Stryker’s Mako system with total knee replacements and Medtronic’s Mazor X Stealth with spinal surgeries. The robotic market for orthopedic surgeries is expected to grow to over $4B by 2029 alone, while spine surgeries are expected to grow to $988M by 2028. Introducing new clinical applications will be vital in the effort to further popularize RAS.

Driver for Market Adoption - Better Surgical Results

Robots are not intended to replace humans, but they have been shown to improve results by complementing surgeons. A 2020 study revealed that surgical success rate with robots (for laparoscopic surgery for distal gastrectomy) was 98% vs 89.5% for conventional surgery. Yes, this is somewhat cherry-picked, but it demonstrates a measurable performance gap in a typical minimally invasive procedure. For reference, robotic surgery is widely considered to have a roughly 95% success rate, so distal gastrectomies do not represent any kind of outlier.

In another study of prostatectomy procedures, results indicated that robotic surgery patients experienced a shorter stay in the hospital (2 vs 3 days) and measurably lower requirements for blood transfusions (2.7% vs 20.8%). Again, these studies are conducted in the context of a specific type of surgery, so the results will vary from one discipline to the next.

On a more technical level, robotic surgery has a high success rate because it provides surgeons with advanced visualization as well as improved dexterity - 360 degree rotating heads can pivot and move around more efficiently than a human. This leads to fewer mistakes and more precision, offering patients a higher level of care and shorter hospital stays. In the case of Ion, accessibility to deeper parts of the lung can lead to earlier diagnoses. Robotic proponents argue that these are the main drivers of robotic surgeries - quicker, more efficient and overall better healthcare.

Robotic-assisted surgery also offers a longer-term value proposition via shorter hospital stays. Inpatient stays can limit the number of procedures performed, so reducing the average length of stay can lead to an increased surgical volume, creating a ton of value for healthcare facilities.

Geographic Breakdown

The U.S is currently the company’s strongest market, but they are gaining traction internationally. Despite lockdowns and legal/regulatory obstacles, China has become Intuitive’s second largest market. It’s a tricky market because the China National Health Commission limits the number of surgical robots imported each year. In 2020, 225 robots were imported, and 161 were Intuitive systems. Keep in mind, this means that 71% of ALL robotic systems imported in 2020 were developed by Intuitive. While China is a strong market today, it’s possible that political tensions could cause problems in this market, so this is something to keep an eye on.

China also represents a large opportunity for Ion. An estimated 300 million smokers reside in China, nearly 33% of global smokers. Combine that with some of the world’s worst pollution, China is a hotbed for lung cancer. Seeing over 1 million cases of lung cancer each year, this market is ripe for advanced lung biopsy machines. With a 71% share of China’s surgical robot imports, Intuitive stands to benefit from these conditions. I need to mention that Ion has not been approved for clearance in markets outside of the U.S. Any speculation on market opportunities in China are dependent upon regional health commissions clearing Ion for medical use on humans.

Regarding Da Vinci usage, I found it interesting that the most common international procedure segment has historically been Urology, followed by general surgery. In the U.S market, only 13% of procedures performed were categorized as Urological, while 53% of procedures were general surgery operations. Management described international general surgery growth as early-stage, which is an exciting proposition for investors if this procedure segment takes anywhere near a 50% procedure share.

ASC Opportunities

Ambulatory surgery centers (ASCs) could play a role in the continued growth of the robotic surgery market.

Ambulatory Surgical Center (ASC) - outpatient facilities that offer surgical and diagnostic procedures, focusing on same-day care.

The growing popularity of ASCs has resulted in a reduction in hospital in-patient surgeries as many of these operations have shifted to ASC facilities. In fact, the global market for ASCs is expected to almost double from $75M in 2020 to $117B in 2027.

A Healthcare BlueBook and HealthSmart study revealed that ASCs reduce outpatient surgery costs by $38B annually because these facilities provide patients with less expensive outpatient care than hospitals. Additionally, ASCs are increasingly acquiring surgical robotic systems for the more complex procedures. Several examples of ASCs utilizing Da Vinci systems are the Atlanta Minimally Invasive Gynecologic Surgery Center, Health East Ambulatory Surgical Center and Hutchinson Ambulatory Surgery Center. ASCs provide a better ROI on surgeries, so it’s no surprise that these types of outpatient facilities are seeing increased popularity.

As a manufacturer of multi-million dollar advanced surgical machines, Intuitive will directly benefit from a potential reduction in their prospective customers’ operating costs. The cost of acquiring a Da Vinci system is an obstacle for many potential customers, so the shift to ASCs will prove favorable for Intuitive’s growing client base.

4-Bull Case -- Roadmap to Continued Dominance

Barriers to Entry for Competitors

While there are several competitors in this space, the capital intensive nature of developing surgical robots is an enormous barrier to entry for new competition. Couple that with an economic slowdown that will surely make things difficult for smaller competitors, Intuitive is an industry giant that will be difficult to dethrone.

One of the reasons Intuitive has maintained a position of leadership is because their systems can be used to perform a multitude of procedures. Developing the world’s greatest machine designed for a single purpose is great, but it’s a tough sell for healthcare facilities that require a more universal device. The Da Vinci systems have withstood growing competition because they do provide surgeons with the flexibility to perform a variety of procedures. Not only is this budget-friendly, but limiting the number of machines a surgeon must learn to operate is a strong selling point against competitors offering highly specialized systems designed for a singular type of procedure.

It’s also worth noting that developing medical devices involves navigating a ton of regulatory hurdles, especially for sale overseas. Considering the legal requirements these machines must meet, the process for the development and approval of new systems is lengthy.

Loyalty, Stickiness, Pain of Switching (Take your pick)

When a healthcare facility purchases a $2.5M surgical device, they really don’t have a lot of incentive to ever switch to a different system. Barring extreme circumstances, it’s difficult to rationalize buying an entirely different machine that surgeons would need to spend countless hours learning. Not only is training time-consuming, but it can be expensive as well. As a result, customers keep coming back to Intuitive (as evidenced by their 80% market share). The charts below provide a visual on how IDNs and hospitals have not only stayed on board, but purchased additional systems.

As I’ve discussed at length, the true value of these systems lies in the recurring instrument sales. A higher install base means more procedures which leads to more instrument revenue. As Intuitive brings new systems to market, the company has a firm foot in the door with loyal hospitals and IDNs who have already implanted Da Vinci and Ion systems in their facilities.

Industry-Leading Innovation

The title of “first-mover” is often overused as a defining component of a wide moat. The concept of a first-mover advantage is definitely real initially, but taking market share and retaining/expanding market share are totally different. Maintaining market leadership requires the flexibility to adapt to evolving trends and the agility to stay ahead of newcomers. In short, the disruptor is fighting a constant battle to not become the disrupted.

But how does this actually play out? Well one advantage that comes with being a first-mover is an established and trusted brand. When a company like Intuitive brings a new product to market, the brand they have established for themselves helps to sell their products. We can talk about the various accepted components of a moat all day, but when a company’s new products sell themselves simply through the brand name (Apple, Tesla), that is the deepest and widest moat of all. Look no further than Intuitive’s latest surgical system - Ion. The rate of adoption for this new device has quickly accelerated from 3 to 129 in just two years, even without the ability for the company to sell the system overseas.

Musings - Digital Solutions

Beyond the reliability and economics of the subscription model, one of the reasons I love SaaS companies is because they use data as a way to keep customers around. I’ll explain. Some companies store their customers’ data in proprietary storage systems that are difficult to migrate to more universal formats. Others gate data generated on their platform behind subscriptions while some may use AI/ML to learn and optimize a customer’s system. In each scenario, the SaaS vendor uses data to discourage customers from switching. It doesn’t show up on Intuitive’s financial statements, but the company actually finds itself in a similar situation as they sit on a large amount of extremely valuable customer data.

Through the My Intuitive App and Intuitive’s hosted and managed services, the company offers a platform that compiles and presents surgical data into a form that surgeons can analyze and disseminate to improve future procedures. As of right now, it appears that these digital solutions are essentially complementary:

The way we do our financial analysis, some of them are value creating through efficiency and labor savings on our side or on the hospital side and the investments are really a reduction in our cost to serve” - Gary Guthart, Chief Executive Officer

While not charging customers to use these solutions is a show of good service, the platform and data collected by the Da Vinci and Ion systems are extremely valuable. I’m not suggesting Intuitive start immediately charging subscription fees for these services, but I do wonder about the potential monetization opportunities the company may be sitting on. The extended-use program for instruments and accessories was an effort to improve their customers’ operational efficiencies, so the company has built up a certain level of good faith. These are purely musings on my end based on little else beyond facts about the platform and the data collected from surgeries. At the moment, it doesn’t appear that the company has any intention of charging customers for their digital offerings.

5-Bear Case -- What Could Derail Intuitive?

Slowing Innovation

Since the company’s inception, Intuitive has been the dominant force in this market. While there’s no denying that this in an enviable position to be in, maintaining this level of market leadership will mean continuing innovation. I won’t sit here and argue that there are any red flags in the innovation department, but it’s worth pointing out that other companies are starting to introduce certain clinical applications more quickly than the industry giant.

For example, in the lung biopsy realm, Auris Health (later purchased by Johnson & Johnson JNJ 0.00%↑ ) developed the Monarch system that has been performing bronchoscopy procedures since 2018. Despite accelerating Ion installs and procedures, Intuitive did not bring this particular robotic technology to market until 2019. Additionally, the Monarch had performed 2000 procedures by early 2020, when Intuitive’s Ion was still in low double-digit operations.

With an 80% market share, Intuitive’s growth is contingent upon maintaining and continuing to capture a huge chunk of this market, even as the competitive landscape grows. The high barriers to entry for robotic surgical systems do provide some cushion, but the players that have already joined the game are worth keeping a very close eye on.

Make no mistake, Intuitive is the dominant force in surgical robotics - and there really isn’t a close second. On top of that, CEO Gary Guthart has been with the company since its inception and has been very involved in system design and engineering since the beginning. It is simply worth discussing that it is vital that this company keep innovating because competition is stronger than ever.

What Happens if RAS Adoption Slows?

We already touched on this a bit, but Intuitive is simultaneously fending off competitors while acting as a spokesperson for robotic-assisted surgery. Before they even have the opportunity to convince potential customers to choose Intuitive’s systems, the customer needs to decide that committing to robotic surgery is worth their time and money. So when we look at the total addressable market in terms of procedures per year (20 million), it’s difficult to project the percentage that will actually be performed with robotic assistance due to the industry dynamics at play.

One of the potential headwinds of RAS originates from the group of healthcare professionals who argue that robotic-assisted surgery doesn’t really improve results all that much. They stand firm in their belief that a Da Vinci doesn’t improve outcomes enough to justify the elevated price tag. On the Da Vinci:

This is a technology that is costing the healthcare system hundreds of millions of dollars and has been marketed as a miracle — and it’s not. It’s a fancier way of doing what we’ve always been able to do.” - Dr. John Santa, Medical Director, Consumer Reports Health

An ECRI Institute study concluded that there isn’t enough evidence to suggest that robotic surgery is better than conventional minimally-invasive surgery. However, that same study admitted that there also isn’t any evidence to the contrary, citing the lack of “higher quality studies” in this area. There are a lot of strong opinions on the matter, but I didn't uncover enough evidence to conclude that RAS isn’t at least slightly better.

The truth is, many studies suggest that robotic-assisted surgery offers higher precision, better visualization, reduced blood loss and shorter hospital stays. Those arguing against robotic surgery seem to be more focused on the added cost, which admittedly is a strong thesis point for the bear case and could be a primary contributing factor should RAS adoption slow.

As a final note on RAS adoption, Intuitive has reported fewer systems placed in each of the last two quarters, the most recent of which marked a decrease over the prior year’s quarter. It could be attributed to high 2021 comps with hospitals installing a higher than normal number of systems post-Covid. Q2 2022 was particularly disappointing, but management noted that third generations trade-ins are decreasing as the total number of third generation systems continues to decline (the company counts trade-ins as installs). They also recognized semiconductor shortages as a factor in lower system placements, as well as hospital budget cuts. Regardless, it will be important to watch how this figure trends over the next few quarters because it could provide a lot of insight into the industry sentiment regarding RAS.

Deteriorating Revenue Per Procedure

As a result of the extended-use program on instruments and accessories, Intuitive has experienced a slight decline in revenue per procedure. Since these new instruments can now be used more frequently before requiring replacement, customers don’t need to restock as often. A quality of life upgrade for healthcare facilities, the extended use program does impact Intuitive’s top line. Management noted that procedure volume and mix, as well as penetration into available markets will dictate the degree to which extended use program (and reduction in instrument cost) will impact the business. This sounds like a bet on themselves and their ability to attract new customers and adopt new use cases. However, instrument and accessories revenue has become so large that even shaving off a few percentage points will noticeably impact top line growth.

High Cost of Equipment and Instruments

Growing popularity of ASCs are an important tailwind, but if these outpatient facilities do not continue to gain traction, Intuitive could feel the impact of the high cost of robotic-assisted procedures. In general, robotic-assisted procedures are more expensive than conventional minimally invasive surgeries. In one study, the American Congress of Obstetricians and Gynecologists (2021) recommended robotic hysterectomy for highly complex procedures, but also noted that if all hysterectomies were performed with robotic assistance, the total annual cost would increase by $960M. The table here summarizes various procedure costs, some of which are significantly more expensive when performed with RAS.

Despite the countless advantages offered by robotic-assisted surgery, costs could ultimately sway decision makers as hospital budget cuts have already started to occur across the globe. Additionally, inflation plus an economic slowdown could persuade patients to opt for less expensive procedures, which would certainly prove to be a headwind for all robotic surgical system manufacturers.

A Note on Valuation

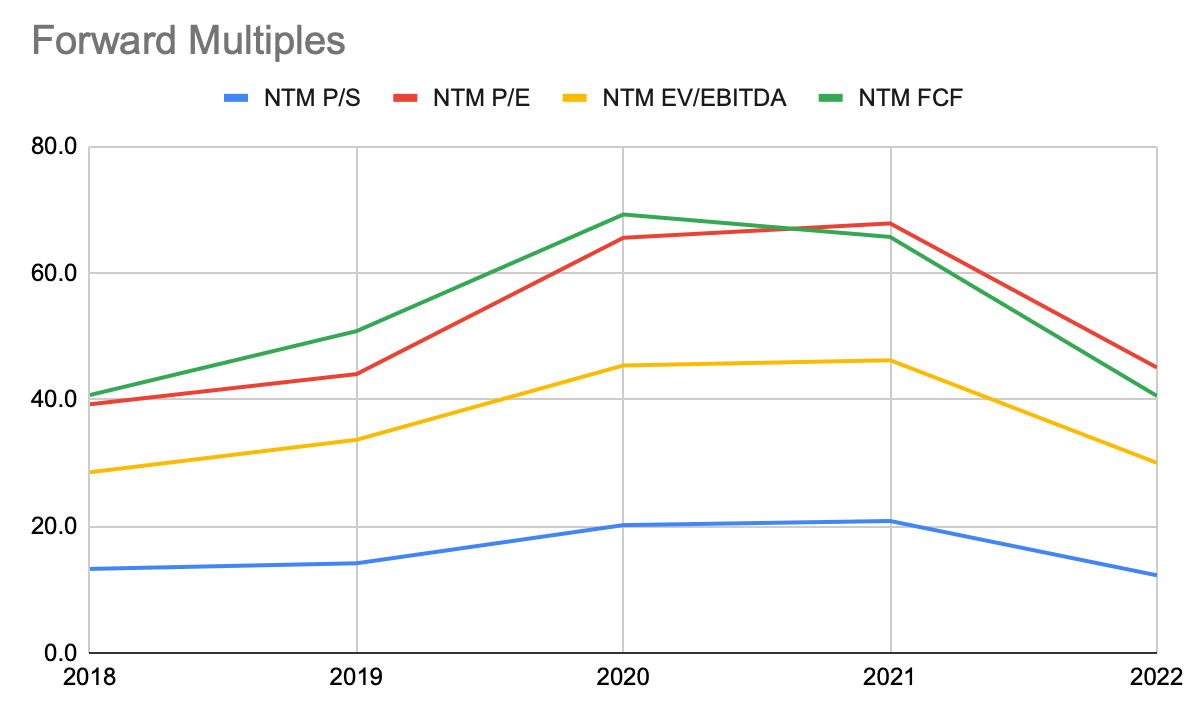

The last thing I’ll mention is that the stock is trading at forward multiples comparable to levels last seen in 2018, when 20%+ revenue growth was priced in. Growth expectations have slowed, as Wall Street is estimating 9% and 12.5% revenue growth over the next two years. If we’re looking strictly at P/S, the stock is trading at a bit of a premium. At this stage, the price/sales multiple may not be the most appropriate metric to use for valuation as the company has been profitable for quite some time. If we look P/E or P/FCF, both are also very high, even on a forward-looking basis. I’m not one to obsess over valuation unless we’re seeing completely absurd growth valuations (2020-2021), but the risk of further compression is certainly there.

6- Closing Remarks

Intuitive Surgical is a company that checks many of the boxes for investors because it offers growth, profitability, strong cash flow, industry dominance and a history of innovation. It competes in a space with extremely high barriers to entry and has established itself as the clear leader by building a trusted brand over decades of operation.

One of the main storylines going forward will continue to be the adoption of robotic-assisted surgery. The industry has many who doubt the return on investment of robotic surgical systems and who question whether or not the machines provide better results. Converting the skeptics will be important, but marketing has proven effective at convincing the public that robotic surgery is their best treatment option. Intuitive has demonstrated the ability to take advantage of this market opportunity, evidenced by a nearly 80% share of the robotic surgery market.

Looking ahead, it will be important to watch reported procedure count and the number of systems placed. The growth of the Da Vinci install base is the company’s most important metric and merits close attention after the most recent quarter saw a significant slowdown in systems placed. Granted, several of the cited reasons were related to the macro environment, but it does demonstrate that the company’s growth is sensitive to a number of outside factors. Once some of these factors begin to dissipate, the company should pick up with continued growth in system placement. If not, it would be cause for concern.

Portfolio Commentary

As of this writing, I do not own shares of Intuitive. This research process has sold me on the business, but I am not a buyer yet for two reasons.

Valuation. Yes, I previously stated that I do not focus too much on valuation. However, the company is in this spot where revenue growth is in the ~10% range, and P/E and P/FCF ratios are both somewhat elevated. If we get another leg down in the market and the stock falls to pre-earnings levels, I will absolutely be a buyer.

I am not aggressively looking to dilute this portfolio with mature-growth stage companies. I love this company, but ultimately I am a growth investor. I would jump all over an opportunity to buy this at lower multiples, but I would rather allocate extra capital to building small positions in younger hyper-growth companies.

Full portfolio as of 8/26/2022:

Announcement on Future Deep-Dives

This latest article, the first in a deep-dive series, is a more granular look at a particular company than I have produced in the past. Because I like the format, I plan to continue to publish a deep-dive on a monthly (optimistic) or bi-monthly frequency. Monthly portfolio updates will continue to be published at the end of each month, and I hope to honor my commitment to earnings coverage as my personal life allows -- my full-time job keeps me plenty busy.

Thanks for reading and don’t forget to follow along on twitter (personal) and Commonstock for announcements on the next installment in my deep-dive series.