Disclaimer: the opinions expressed are my own and should not be mistaken for financial advice. Do your own due diligence before purchasing any equities mentioned in this article.

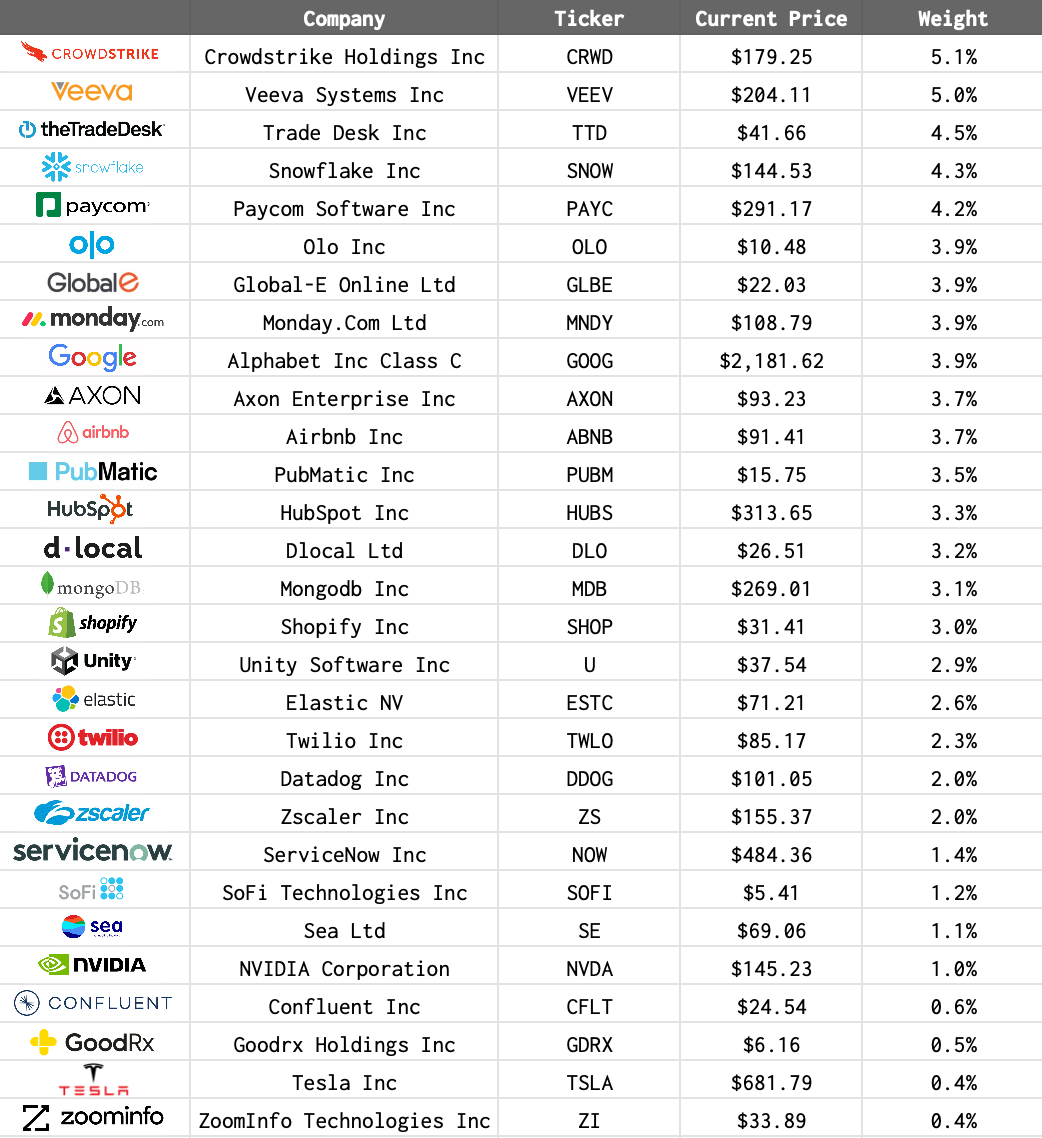

June was a mixed bag for the portfolio as some growth stocks came under added pressure, while others have started to form bases. Ad-tech companies (Pubmatic and Trade Desk) had a tough month while stocks in the cybersecurity space came out ahead (Zscaler, Crowdstrike). Here is the entire portfolio, weights included:

Growth Portfolio - July 1st, 2022

Activity - Buys / Sells

Besides the routine balancing, I did make a few other changes to the growth portfolio. I sold Tractor Supply Company (TSCO) and American Tower (AMT) and initiated a position in ServiceNow (NOW). AMT fits better in my dividend/mature growth portfolio, so I removed that position from the growth portfolio. Tractor Supply Company is a solid company, but I was no longer interested in keeping up with them.

As for ServiceNow, this company has become an IT giant and still has a massive growth runway. I plan to discuss this purchase in more depth at a later time, but for now I will say that this is a very high conviction company that I have watched for a long time and I finally pulled the trigger on it. The goal is to build this up to a 3-4% position.

Top Tier

These are the highest quality companies in the portfolio, and I will be adding to these with each new cash infusion. There isn’t much to say about these - they are the top performers I will not hesitate to routinely purchase.

Airbnb (ABNB)

Axon (AXON)

Crowdstrike (CRWD)

Datadog (DDOG)

D-Local (DLO)

Elastic (ESTC)

Global-e (GLBE)

Google (GOOG)

Hubspot (HUBS)

Monday.com (MNDY)

MongoDB (MDB)

Nvidia (NVDA)

Olo (OLO)

Paycom (PAYC)

PubMatic (PUBM)

ServiceNow (NOW)

SoFi (SOFI)

Snowflake (SNOW)

Tesla (TSLA)

Trade Desk (TTD)

Twilio (TWLO)

Veeva (VEEV)

ZoomInfo (ZI)

Zscaler (ZS)

Middle Tier

The middle tier consists of companies I do not plan on selling, but I am not allocating as much future capital here.

Confluent (CFLT)

I worry about competition from the major cloud providers and the cash flow situation. This was never more than a starter position, so I am still very early in the evaluation stage with Confluent.

Shopify (SHOP)

Shopify is trying to do a lot, and they’re making a number of acquisitions in the process. The development of a fulfillment network could be a huge payoff, or a massive money pit. TBD but I’m doing some deeper research here.

Unity (U)

Unity’s spot on the middle tier may be surprising, but the recent issue with the AI ingesting bad data is very concerning. Yes, they can correct this and get back on track within a few quarters. However, what if this happens again? I do have some concern in this regard.

Lower Tier

GoodRx (GDRX)

The latest earnings report revealed that one grocer (Kroger, I assume) stopped accepting discounts from most PBMs for a subset of drugs. This could be resolved, but it brings into question GoodRx’s entire business model. It would be a disaster if other pharmacies followed suit. I am not adding to GoodRx right now.

Sea (SE)

My biggest gripes with Sea have been their rapid expansion into new markets and geopolitical concerns. With India banning FreeFire, it brings into question Sea’s stability in all of these markets. Garena supports the other two businesses, so if it starts to falter, the other businesses could suffer. Due to geopolitical forces in southeast Asia, I don’t typically feel comfortable involving myself in individual stocks from this region. Sea is a potential mega-winner, so I am keeping this open for now.