Disclaimer: the content within should not be misconstrued as financial advice. Please do your own due diligence before purchasing any equities discussed in this article.

Despite the bloodbath we’ve seen in the market recently, I have done absolutely nothing with the portfolio all month. No buying, no selling, no vacillating - just sitting. Now more than I ever I feel it’s important to just stick to the plan and refrain from making emotional decisions.

I also see this as a great opportunity to deploy cash, but unfortunately I have shifted a lot of my cash toward house projects. As a result, my cash position is quite small, so I am trying to be strategic about adding to my positions.

I don’t even really have any business updates for the past month. There aren’t any negatives to report - just business as usual. I’m watching each of my positions very closely to see how they handle these tough economic conditions. I see this as an opportunity to evaluate each company I own because if they can sustain growth in the coming months, I’ll be thrilled to watch the business when the macro environment improves.

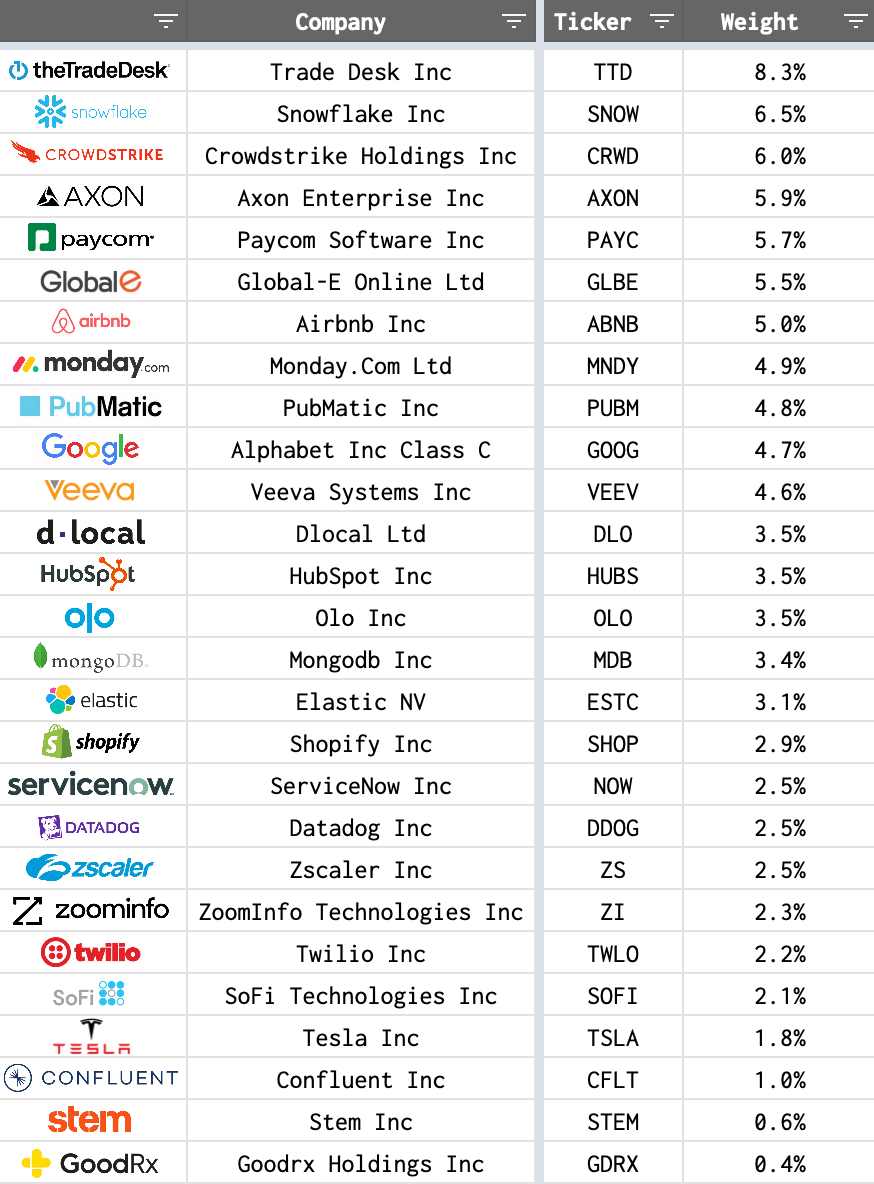

Growth Portfolio - October 1st, 2022

Elite Tier

Airbnb - ABNB 0.00%↑

Crowdstrike - CRWD 0.00%↑

Datadog - DDOG 0.00%↑

Google - GOOG 0.00%↑

Paycom - PAYC 0.00%↑

ServiceNow - NOW 0.00%↑

Snowflake - SNOW 0.00%↑

Tesla - TSLA 0.00%↑

The Trade Desk - TTD 0.00%↑

Zscaler - ZS 0.00%↑

Upper Tier

Axon - AXON 0.00%↑

Confluent - CFLT 0.00%↑

D-Local - DLO 0.00%↑

Elastic - ESTC 0.00%↑

Global-E Online - GLBE 0.00%↑

Hubspot - HUBS 0.00%↑

MongoDB - MDB 0.00%↑

Pubmatic - PUBM 0.00%↑

SoFi - SOFI 0.00%↑

Veeva Systems - VEEV 0.00%↑

ZoomInfo - ZI 0.00%↑

Middle Tier

Olo - OLO 0.00%↑

I posted an article on Commonstock earlier this month about how Olo may stand to benefit from a recession by taking market share from third party services like DoorDash and Uber Eats. When money is tight, people become more likely to order their food online for pickup or use cheaper in-house delivery services. The article does a great job of describing this situation, so it’s something to keep an eye. Olo remains in the middle tier simply because their growth has slowed lately.

monday.com - MNDY 0.00%↑

Shopify - SHOP 0.00%↑

Stem - STEM 0.00%↑

Twilio - TWLO 0.00%↑

Lower Tier

GoodRx - GDRX 0.00%↑

Watchlist and Plans for October

I had originally planned on adding to the following positions in September, but it didn’t end up happening because I needed cash for some house projects. I believe these are best of breed companies, and each has demonstrated the ability to sustain growth as economic conditions have deteriorated. I strongly believe the economy will take a significant amount of time to recover, so I don’t think these companies are out of the woods yet. However, it has been encouraging to listen in on the commentary from management.

These will still be a focal point in October as cash becomes available. SNOW 0.00%↑ and TTD 0.00%↑ have become pretty large positions, but I'm not against nibbling in these names if the market provides the opportunity.

I’m also currently in the research process for DOCS 0.00%↑ and NET 0.00%↑. I really don't anticipate buying any new positions anytime soon, but these are at the top of the list.

That’s all for September. If the market continues to trend lower, I will look to be more and more aggressive because the market is presenting growth stock investors with an incredible opportunity for long-term wealth generation.