Hubspot (HUBS) Analysis

Up over 1,000% since its IPO, can this CRM provider continue to outperform?

Disclaimer: the opinions expressed are my own and should not be mistaken for financial advice. Do your own due diligence before purchasing any equities mentioned in this article.

Before I begin, I want to talk briefly about what I have been working on lately. For a while now, I have been looking for a way to quantitatively score/rank all of the stocks in my portfolio, as well as prospective investments. I’ve seen others in the investing community present various types of frameworks for assessing their holdings and I think this is a worthwhile exercise because it forces us to look at our stocks objectively and also provides a benchmark against which to assess whether a company is improving or declining. The goal is to run every stock in the portfolio through this scoring system and reassess on a semi-annual basis. So if a particular company scores a 65 today but in 6 months it drops to a 62, this is a sign that maybe I need to stop adding, trim or outright sell if I feel the story is changing.

This scoring system has been divided into several sections, each weighted differently: Moat, Financials, Optionality, Management, Stock Performance and Risks. The highest score a company can achieve is a 100, but I have designed this system in such a way that 100 is nearly impossible, and 65+ would be considered a strong score. For reference, I ran the last two write-up stocks through this system - Stem scored a 39 while Veeva scored a 69. I plan to detail this system in a future dedicated article, but for now this will serve as a structural framework for future write-ups. With that being said, let’s talk about Hubspot.

Brief Introduction - What is Hubspot?

Hubspot offers an enterprise-grade, software as a service platform designed for marketing, CSM, sales and service - in short, customer relationship management (CRM). In addition to their primary marketing product, they offer “hubs” that branch off the main platform and are all highly integrated. These are essentially modules or other products a customer may choose to add to their bundle.

This company went public in 2014 and has seen an enormous amount of success, both in business growth and stock price appreciation, despite having to compete with giants like Salesforce, Adobe and Oracle. It can always be difficult for a younger company to compete with industry leaders, but I am going to explain why I think Hubspot has laid the groundwork for a future of continued growth.

1 - Moat

When I evaluate a company’s moat, there are a number of factors that I consider, and each has a slightly different weight. The first thing I look at is whether or not this company is a first-mover or a disruptor. I am generally not interested if the company isn’t disrupting an industry in some capacity. Disruption can come in different forms - offering a unique and never-before-seen product, fundamentally changing the way an industry operates (fintech), or just improving on a product so much that they take market share from industry leaders. Hubspot fits best in this third category. They have taken what Salesforce pioneered and attempted to address some of the pain points to create a better user experience. Fortunately, Hubspot doesn’t even need to become the dominant player in CRM to experience a high level of success - their estimated total addressable market has risen to $87 Billion as a result of new product offerings.

Hubspot’s largest competitive edge is the quality of their platform. It was built on a single code base, meaning customers receive a more unified, seamless experience. By comparison, Salesforce was built through acquisitions and patched together, making it difficult to use and customer experience can vary per application. Salesforce has a notoriously high learning curve, typically requiring admins and a developer team to set up complex processes. While this can work for large enterprises, most companies would benefit from a simpler application, which is why Hubspot has been so successful with small and medium-sized businesses.

Hubspot also benefits from several factors that encourage customers to stick around once they’ve come on board. I gave them a small amount of credit for creating a type of network effect with third party integrations. The company touts these as strong network effects, but I’m not sold, primarily because every software company in this space strives to provide as many integrations as possible. At this point, it’s commonplace to offer integrations with the most popular third party software vendors. I do, however, believe their product ecosystem is quite strong. Each additional hub adds value to the user experience and improves the likelihood that customers will find the functionality they need and stick with Hubspot. The company is also less likely to experience high churn rates as customers adopt more products. CRM software is vital to a business’s marketing operations as platforms like Hubspot store massive amounts of critical customer data and are central to highly integrated workflows. For this reason, it is difficult and painful to switch vendors.

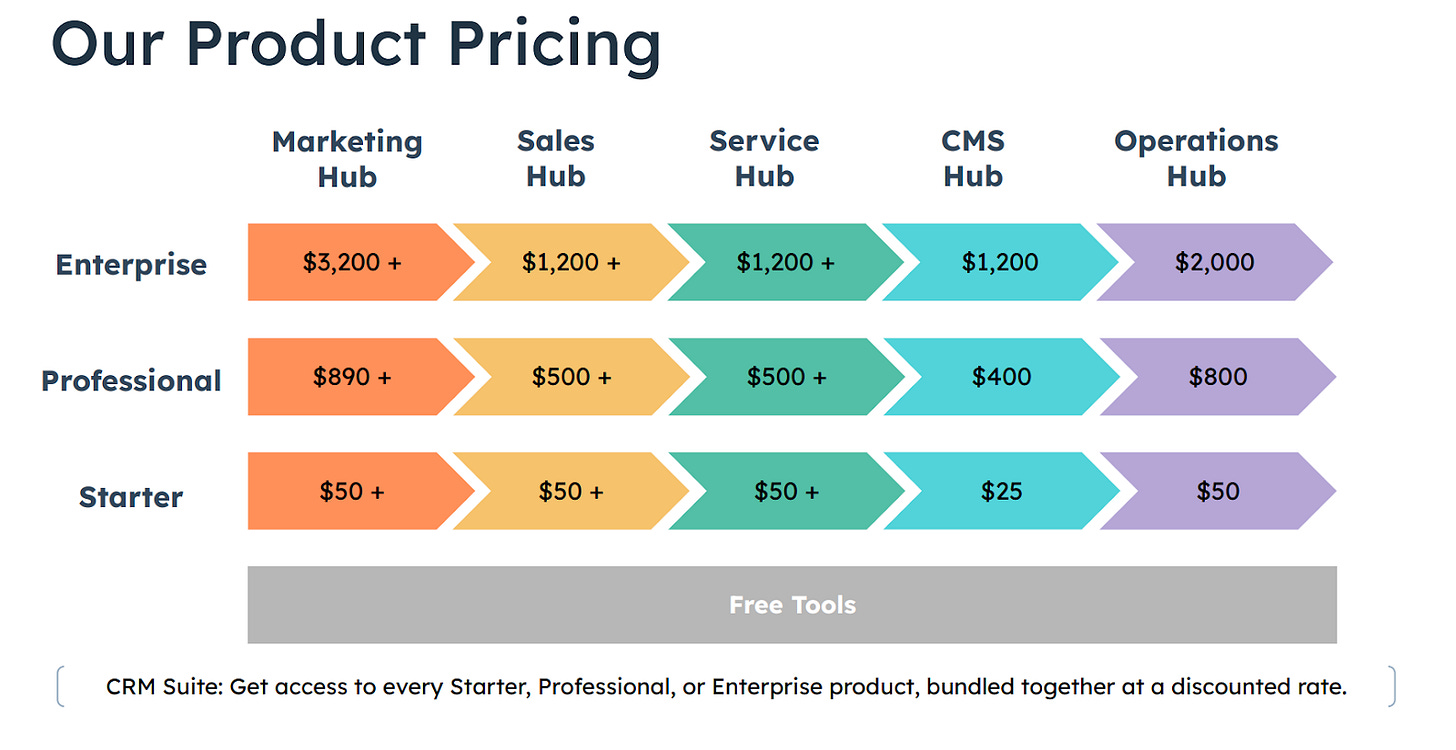

Pricing can be tough to evaluate because of head count, bundling and other costs that are not widely available to the public on a company’s website. However, countless reviews suggest that Hubspot is a vastly cheaper product than its largest competitors. Their freemium pricing strategy helps to attract mid-market customers as they are able to trial the platform and scale as they recognize the value it provides. Once on board, Hubspot is also significantly cheaper than Salesforce, for example. This is ideal for Hubspot’s small and medium-sized customers as the per user pricing model employed by Salesforce requires higher initial overhead.

So how did I score this company? For their impressive product ecosystem, large and growing TAM, high switching costs and various competitive advantages, Hubspot ended up with a 12 out of 25. This may seem low, but I designed this moat scoring system in such a way that only truly exceptional companies will score high in this section. For instance, Hubspot is lacking brand recognition, unique products, first-mover status and strong network effects. 12 is a decent score, but I believe the company can improve this over time, which is why it will be important to reevaluate on a semi-regular basis.

Score: 12/25

2- Financials

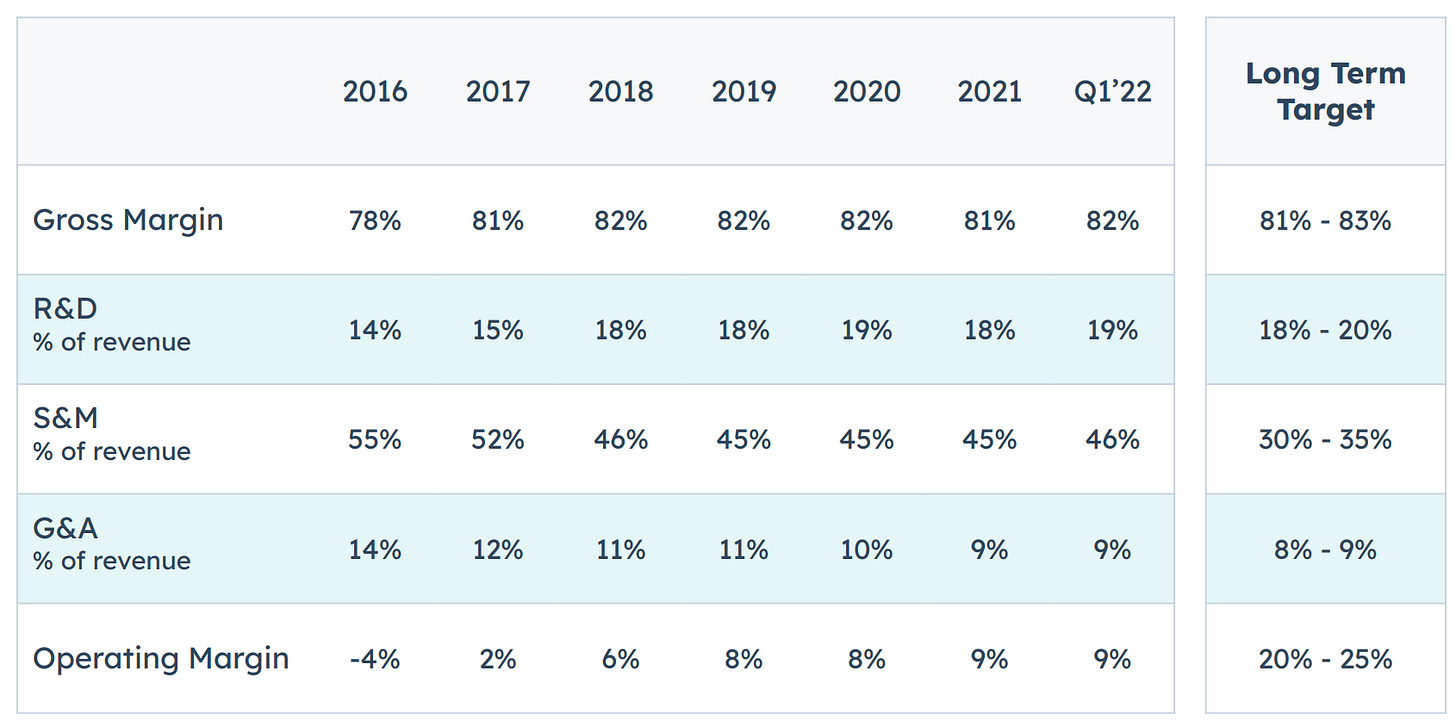

Looking at Hubspot’s financial profile, revenue growth and gross margins stand out. This company has continuously demonstrated the ability to growth revenue 30%+ year-over-year. They actually experienced some significant acceleration in 2021, with top line growth coming in at 47% on a YoY basis. The high revenue numbers have also translated to impressive gross profit figures as the company has repeatedly produced 80%+ gross margins.

The downside is that much of that growth was costly to obtain - sales and marketing expenses were nearly 50% of total revenue and over 60% of gross profit. Management has provided this graphic that displays their long-term target for S&M costs, which they expect to be in the 30-35% of revenue range. This is still somewhat high, but Salesforce sports similar numbers to Hubspot, which could indicate that this particular industry requires more exhaustive sales efforts.

Switching gears, Hubspot has seen a sizable jump in free cash flow in FY 2021, improving 300% over 2020 numbers. With free cash flow margins up to 15%+, Hubspot is positioning itself well on a cash-generation basis. The downside is that the company hasn’t exactly grown their cash position relative to debt. They currently hold more debt ($781M) than they do cash ($411M), which is typically something I try to avoid. While free cash flow numbers are strong and improving, I had to knock off some points for their debt position, especially as the economic environment turns toward a possible recession.

Despite strong top line growth and increasing free cash flow, Hubspot still isn’t profitable on a GAAP basis. This is the result of some moderate stock-based compensation, which is common for this type of growth company. To take stock-based compensation out of the equation, I mostly evaluate these companies on a non-GAAP basis. If we use this metric, Hubspot grew earnings 43% YoY for Full-Year 2021 and posted 75% earnings growth in the most recent quarter. Growth is strong, but I am still taking off points for the lack of any GAAP profitability. Overall, I gave Hubspot a 19 out of 35 for their financial state.

Score: 19/35

3- Optionality

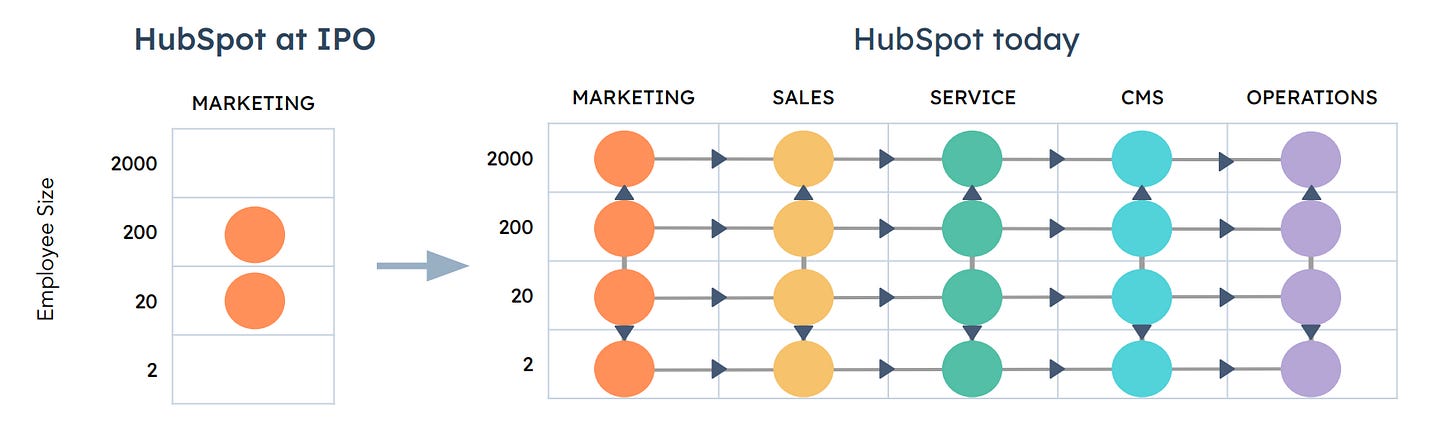

Hubspot began as a single application, but has grown into a complete platform. This company is a near-perfect example of how optionality should play out, as Hubspot has added new products, solutions and functionality that all fit together seamlessly. The graphic below was taken from a Hubspot investor presentation and it demonstrates not only how the platform has grown, but how the hubs are all interconnected.

When I look at optionality, I am focused on a few different things: new products, new verticals, opportunity to upsell customers and whether or not there is still room to grow. Hubspot checks off the “new product” box, as the company has continuous expanded the platform. This graphic helps us visualize how innovation has kept up revenue growth. I also want to point out the very few acquisitions in this graphic - further proof that this company has a totally different organic growth mindset and platform expansion strategy than Salesforce.

The next component of this optionality ranking is a company’s ability to expand into new verticals. This graphic is very similar to an earlier visual, but it does a good job demonstrating how Hubspot has dramatically increased their total addressable market by expanding into Sales, Services, CMS and Operations hubs. Additionally, the platform has become a more efficient scaling machine, initially focusing on businesses with 20-200 employees. Hubspot now serves business of all sizes, presenting the company with a much larger total addressable market.

As the Hubspot platform has added new products and expanded into new verticals, it has enabled the company to extract more revenue from their customers. This is evidenced by their net revenue retention rate, which has improved from 99.9% in 2019 to 102.3% in 2020 all the way up to 115% in 2021. The following pricing figure provides insight into how each additional product can fuel this net revenue retention growth. It is also important to note the role of this platform’s cohesiveness. All hubs are highly integrated and seamlessly connected, encouraging customers to adopt additional hubs due to ease of use.

The trickiest part of this scoring system is analyzing (and projecting) a company’s future potential. We can look at total addressable market, growth rates, net revenue retention and new product releases to get a decent idea of a company’s future prospects, but there is always uncertainty. For Hubspot, I look at what Salesforce has done and see a lot of future potential, whether it be creating even more modules or industry-specific solutions. Hubspot isn’t necessarily offering anything revolutionary, but they are improving upon what industry leaders like Salesforce have already pioneered. For that reason, I had to take off a few points. Despite knocking off points for future potential, Hubspot scored extremely well for optionality, earning 16 out of a potential 20 points.

Score: 16/20

4- Management

Another bright spot for this company is the management team. I love founder-led businesses, and both of Hubspot’s co-founders are still very much involved with the company. Brian Halligan serves as an executive chairman while Dharmesh Shah is the chief technology officer. For technology companies like this, it’s always comforting when the CTO is a founder. I like it when the people who built the software are still in charge of growing the platform because it shows me that the minds in charge of the products’ success are still tackling future development efforts.

While both founders are involved, neither serve as the CEO. That duty rests on the shoulders of Yamini Rangan, who has an extensive background in electrical engineering and industry experience at Workday, SAP and Dropbox. She has also garnered strong reviews on Glassdoor.com, receiving a 92% approval rate to go along with Hubspot’s 4.6 star rating.

The only real knock I have against Hubspot’s leadership is the lack of insider ownership. Insiders only own about 5.6% of the company, which isn’t a red flag, but it is a bit surprising that this figure isn’t higher. Regardless, management is strong and I’m particularly happy that Dharmesh Shah is still running the show on the technology side.

Score: 11/15

5- Stock Performance

In short, Hubspot has destroyed the S&P 500 since its IPO, returning 1000% to the index’s 95%. They also routinely outperform guidance, beating on earnings and revenue expectations on a consistent basis. Additionally, I love that the market has reacted well to earnings reports. It’s not a dealbreaker for me if the market whips a stock around post earnings, but I do tend to prefer favorable reactions for my own sanity.

Score: 5/5

6- Risks

As with any growth stock, there are always risks to be aware of. I have chosen to design this section purely as a point deduction tool.

The first risk to watch out for is the company’s sales and marketing spend. Hubspot currently spends roughly 50% of total revenue and 60% of gross profit on sales and marketing. Management aims to drop this down to between 30 and 35%, but they have a long way to go. It will be important to monitor these metrics because if the company needs to increase the percentage of sales and marketing expenses to keep up with revenue growth, that would be a bad sign.

Another risk to watch for is competition. There are many competitors in the CRM landscape, with Salesforce being the leader and pioneer of the customer relationship management cloud. Tech giants like Adobe and Oracle offer competing software, as well as smaller companies such as Zoho. As Hubspot increasingly goes after enterprise customers, competition will intensify.

Investors will also need to be aware of potentially high customer churn. Hubspot does offer enterprise-grade CRM software, but they appeal to small and medium-sized businesses because they offer high scalability. When a company serves a lot of smaller-sized businesses, churn is always a concern. I will be watching net revenue retention rate as the economy worsens as macroeconomic conditions test smaller and medium-sized businesses.

For risks, I took off a single point for heavy competition. I chose to ignore churn because it is not currently presenting itself as a problem per net revenue retention rate and customer count. If these metrics start to dwindle, I will have to reevaluate the company’s risk profile.

Score: -1

What to Watch For

Before adding up the point totals, I want to discuss what I will be using to reevaluate Hubspot later this year. Aside from revenue, income and cash flow, management has identified several key business metrics that we, as investors, can use to gauge the company’s performance over time - customers, average subscription revenue per customer, and net revenue retention. All three metrics provide important insight into the company’s ability to attract and retain customers.

Customer count is a strong indicator of both market penetration and growth of the business. Each new customer represents the opportunity to extract additional revenue through expansion into new hubs. To measure this, the company tracks Average Subscription Revenue per Customer, which demonstrates Hubspot’s value proposition to its customers. As customers adopt more hubs, the average subscription revenue value will reflect that. Net Revenue Retention drills down further and paints a picture of how much more money recurring customers are spending year-over-year. Tying these metrics together, we can quickly evaluate the quality of the company’s revenue growth and obtain a general idea of the state of the business.

Final Thoughts

Summing the final point tallies, Hubspot scored a 62 out of 100. This may seem like a low score, but it falls somewhere in the middle of the companies I have evaluated and is definitely what I would consider an investable company. I feel good about the company’s optionality, but I want to see Hubspot continue to build and strengthen their moat and fortify their balance sheet. They offer an outstanding product, and with Salesforce’s reputation as being difficult to implement and unfriendly to users, Hubspot is well positioned to attract customers who don’t want to deal with the high initial overhead and headache, especially with a possible recession looming. I do own shares, but after running it through this gauntlet post-earnings, I am not planning on increasing the position weight at this time.

Final Score: 62/100

Position: 3.5%