In this week’s edition, I want to discuss a rapidly growing company that believes they are pioneering a new category of software. I do own shares, but I recommend doing your own due diligence before purchasing any of the companies discussed. With that being said, here are the reasons I believe Monday.com has a long growth runway, as well as several risks that potential shareholders must be aware of.

Company Overview

What is Monday.com? Put simply, this company is a provider of work management software. They offer a highly customizable cloud-based Software as a Service (SaaS) platform that enables customers to streamline their organization’s workflows. Monday.com’s offering is different than their primary competitors (Asana and Atlassian) in that it is built using WorkOS - a modular architecture where customers deploy available building blocks (or create their own) to design highly customized workflows to suit their needs. This platform is marketed as a “no code / low code” solution that essentially provides customers with the tools they need to easily build work management applications. Monday.com is fixated on offering a replacement for rigid, legacy solutions where designing customized applications would require a software development team, if that capability was supported at all. The foundation of this platform is a modern way to approach software applications, and is one of the reasons I feel this company has a ton of room to grow.

Open WorkOS Building Block Architecture

In my initial research, there were three companies that stood out in the work management software space: Asana, Atlassian and Monday.com. I actually purchased Asana and Monday.com at the same time, albeit small starter positions (< 1% of total portfolio). At the time, I could not decide between the two because they both offered hyper-growth (more on that later), strong management teams and well-received products. As of today, I have completely cut out my Asana shares and built a full position in Monday.com. Why? I am betting on this open WorkOS building block architecture.

One of the problems Monday.com was designed to solve is reliance on rigid work management software. As organizations become digitized and geographically distributed, they become more reliant on connectivity. Teams across different departments need to collaborate, but they often have different needs that their work management software must meet. Rigid legacy systems require teams to adapt to them, while Monday.com provides the means for the software to adapt to the employees’ needs. Their WorkOS platform uses modular building blocks - things like views, columns, automations, integrations, and many more - that can be dragged and dropped to create a tailored workflow. These building blocks are no-code, so anyone can create customized workflows. This platform grants employees a whole new level of accessibility and agility - as organizations grow and change, Monday.com is there to provide the flexibility to quickly and easily adapt to evolving workflow requirements.

The reason I believe this is so significant is because the building blocks serve as a form of optionality for the company. Monday.com is constantly creating and innovating new building blocks, but they also allow external developers to do the same. They can share these solutions in the app marketplace which, combined with a growing developer community, has created a network effect. As the marketplace grows, use cases will evolve and this can actually open up new verticals. If management continues to prioritize developing new building blocks and improving existing solutions, Monday.com could position themselves as the leader in work management software.

Hyper-Growth

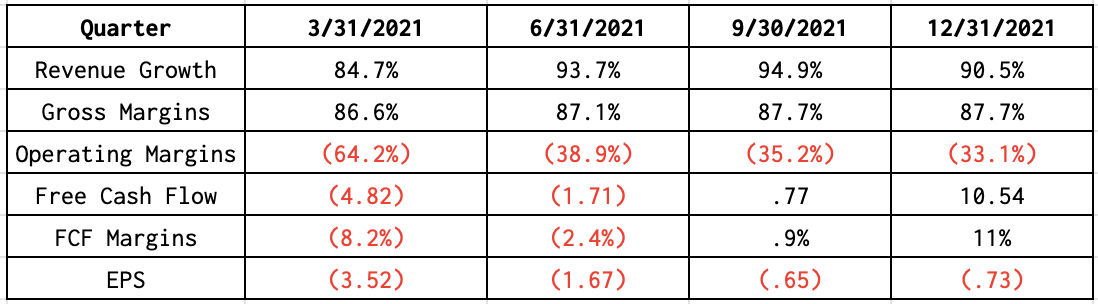

One of the most enticing things about this company is how rapidly it is growing. Looking at the last two annual reports, revenue has grown 106% and 91% year-over-year in 2020 and 2021. Gross profit is growing even faster than sales, posting 110% and 94% growth figures over the same period, resulting in impressive gross margins around 87.3%. If we zoom in and analyze financial results on a quarterly level, the rapid growth picture becomes even more clear. Gross margins are expanding while the company is also experiencing a large influx of free cash flow. The downside is that Monday.com continues to post negative operating margins (due to sales / R&D expenses) and they are still not profitable, and likely won’t be anytime soon. However, for a young growth company, these guys are quickly fortifying their balance sheet. The following table summarizes key metrics from the last four quarterly reports (FCF in $Million):

Market Opportunity and Industry Tailwinds

Monday.com has already demonstrated incredible growth, but they still have a massive market opportunity. Management estimates the total addressable market to be $87 Billion by 2024, representing a 12% compounded annual growth rate (CAGR) from 2020. Within that market, the company has strong industry tailwinds powering their growth opportunity.

The main tailwind is the ongoing shift toward digital work. Covid certainly was a contributing force with many employees now permanently working from home, but with so many organizations distributed across different cities and countries, digital work and collaboration are now commonplace. According to the IDC, an estimated 65% of global gross domestic product will be digital in 2022. Monday.com is poised to benefit from this secular shift toward distributed workforces because organizations have already become more reliant on work management software due to increased cross-departmental collaboration. Teams also require greater agility, frictionless software adoption, and automation to improve workflow efficiency. Monday.com’s leading WorkOS building block architecture provides a high degree of accessibility that cannot be matched by rigid work management solutions. It empowers employees to create customized, solutions to suit their needs without involving software developers. The platform was designed to eliminate inefficiencies and offer a means for customers to build exactly what they need in a work management product. I firmly believe the digital work shift is truly secular, and this company is well-positioned to take advantage of these powerful industry tailwinds.

Optionality

Evaluating optionality, in most cases, comes down to the variety of product offerings and a company’s ability to innovate. Monday.com is built differently, so it is important to look at how they have evolved these building blocks over time. The company’s 424B4 filing provides an excellent visual of the company’s history of releasing new functionality into the building block ecosystem.

This graphic clearly demonstrates that revenue has accelerated as new building blocks have been added. New blocks bring new functionality, which reveals new use cases, which in turn provides the opportunity to expand into new verticals. With the apps marketplace, Monday.com can rely partially on their own customers and the growing developer community to create new building blocks. As the customer base grows, this network effect becomes more powerful, which is an exciting proposition for shareholders.

Management Performance

Monday.com was co-founded by Roy Mann and Eran Zinman, who still run the company today (as co-CEO’s). They have received a 97% approval rate on Glassdoor.com to go along with an overall company rating of 4.7 stars, which is one of the highest I have come across in my research on many SaaS companies. In addition, insiders own roughly 32% of the company, indicating that management has a large amount of skin in the game.

Looking at the stock performance, results have been volatile. The company went public in June 2021 and has taken shareholders on a wild ride. This stock traded as high as $450 as recently as November, and currently sits around $130 as of this writing, slightly below the IPO price of $150. I don’t necessarily take much away from this, as valuations were extremely stretched across the board due to quantitative easing and the stock has come down to a more reasonable multiple (13x forward sales). Their first two earnings reports as a public company garnered strong, positive reactions from the market, while the recent report was not well-received. I contend that this latest report brought this stock down to a fair valuation and the reaction had less to do with the business itself and more to do with macroeconomic conditions and more down-to-earth guidance. The positive is that the company beat wall street estimates all three quarters as a public company (by 50%+ each time).

Technical Analysis & Valuation

As mentioned, I feel that this stock has a fair valuation (on a forward sales basis) for a young company with a lot of growth ahead of it. Investors in general have adopted an extraordinarily bearish sentiment, so I see the potential for more downside in the coming weeks.

Looking at the technicals, the stock has established somewhat of a near-term support zone. It recently retested the all time lows post-earnings and quickly rebounded before drifting back into the support area. This could be an accumulation zone, but it will be important to watch the 110-120 level if the indices continue to drag growth stocks down. Personally, I have already deployed cash in recent days to fill out my position as I believe the market is offering an excellent price for this company.

Risks

While there is a lot to be excited about, it’s important to be cognizant of the potential risks involved with investing in this company. For one, this is a competitive space filled with companies offering a similar product. Wrike, Smartsheet, ClickUp, Teamwork, Basecamp and Microsoft all offer different flavors of WorkOS platforms, while Asana and Atlassian are fast-growers and co-leaders with Monday.com in work management software. Despite the competition, Monday offers an open WorkOS with a growing developer community, which I believe is a strong competitive edge. Additionally, Monday.com is consistently applauded for the ease-of-access it offers customers.

Another risk I see is the potential for the industry to not adopt WorkOS. If this trend does not continue to gain traction, it would likely spell doom for this company, so this certainly needs to be closely monitored going forward. With that being said, I see enormous potential as companies seek to adopt software that can easily be tailored to suit their needs and does not bring a high degree of complexity. Additionally, Monday.com has seen a growing net dollar retention rate from Q3 2021 to Q4 2021 (130% → 135%), which suggests that customers are happy with the product and continue to not only remain on board, but spend more money on the platform.

Finally, the company is not yet profitable and will not be posting positive earnings anytime soon. Young companies in their hyper-growth stage purposely reinvest a large portion of sales into the business, so this is definitely normal. However, revenue growth will only satisfy the market for so long, especially in this macro environment. I want to see management provide a roadmap to profitability before I add to my current holdings.

Position: 5%